Whilst we seek passive, patient capital for our direct investments, above that we seek those entrepreneurial investors who readily appreciate that quality management and leadership is at the heart of any great investor outcome. As a management-first investor-advisor this is crucial.

We do encourage the value-add of connectivity and where feasible seek to match those investors who have the most appropriate first-hand experience or network connectivity that will prove an added catalyst to any opportunity. Together we can bring our collective experiences, network and talents to bear in a once in a lifetime economic environment.

We only seek to engage with those parties who would determined by the FCA to be High-Net-Worth or Sophisticated Investors, often with prior experience of such investment schemes. Should you have any doubts as to whether you qualify as any of these please seek the advise of a qualified Independent Financial Advisor.

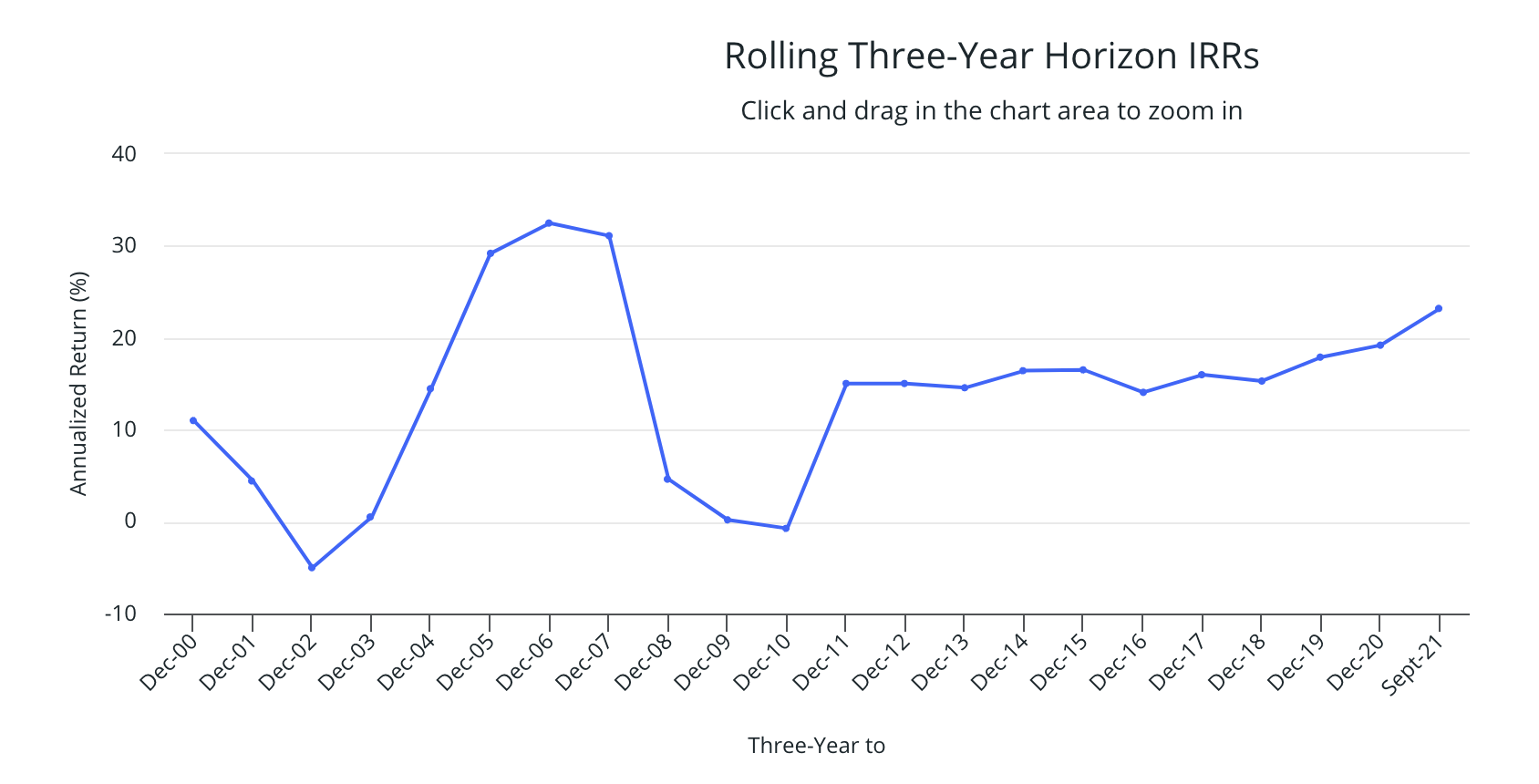

Whilst there is significant deviation between funds, across the spectrum, IRR for buy-out funds globally have ranged 10-20% typically. Only when factoring in the global-financial-crash and the dot-com-bubble have we seen any material divergence from this and even then that was only for a shallow period.

Our thesis is that by selecting top-tier management, creating meritocratic incentives and building a bespoke acquisition strategy and structure to each opportunity, we aim to create market beating returns for our investors and management.

source: Preqin Global - private equity 15-year data series

In a competitive mature market, innovation should be continually advancing the competitive frontier. Instead, with material differentiation actively avoided and so much control (over the value) afforded to principals, a counter-intuitive malaise exists where common practices are so profitable that there seems almost a disincentive to break those norms.

It’s often unknown by most new to private equity that most funds deployed are loan notes not equity and that the return on that equity is so high that just discharging those loan notes on exit accounts for a material portion of a funds expected IRR.

It is our thesis that by changing the financial engineering at transaction and group level and focusing explicitly on best-team-best-incentive, that we can engineer expected 5-yr returns in excess of 500% instead of 150-250%.

of funds deployed by PE are loan notes

is the average coupon of PE loan notes

% of IRR just from paying loan notes

Given the current market conditions we believe that by providing a management-first proposition, we will have access to not only the best talent on the market but also create a new market by bringing to market those leaders and teams who are presently not engaging with traditional private equity for all of the reasons we note inefficiencies on the home page. By definition, having access to the best talent in the market can only enhance the prospect of our future returns.

Our structuring ensures that management always have in excess of 51% of the capital stack on any transaction. By creating such a depth of meritocratic reward we expect to see that incentive reflect in performance and therefore ultimately the returns profile delivered from our transactions. It’s a consistent feature of Independence transactions that aside from the leadership management pool, the wider operational and second-line employees are also encouraged to participate in the risks and reward of ownership.

Over 53% of private equity transactions have only one party in the financial stack. This, whilst proven to be profitable and ensure control, leads to inefficiency and opportunity loss by constraining the maximum possible return. Our structuring will often entail multiple parties throughout multiple levels of the financial stack and in doing so create an economic efficiency from deployed capital that should create returns greater than the normal by an order of magnitude. By being able to draw on years of advisory, debt, equity and restructuring experience; Independence are able to build structures which lead the market.

Capital is at risk. The value of an investment, and any income from it can fall as well as rise and investors may not get back the full amount they invest. Any transaction in which we may be involved should be considered longer-term investments. They may be higher risk and illiquid. Tax reliefs are dependent on investors’ individual circumstances. Current tax rules are subject to change.

Past performance is not a reliable indicator of future performance. Independence Capital does not provide investment, legal, tax or other advice to its investors and the information on this website should not be construed as such. We recommend investors seek advice from a regulated financial adviser.